Exploring Your IRA Options

An IRA can help you save more for retirement.

Explore the differences between a Traditional IRA and a Roth IRA and decide which one is right for you.

Choose the way you save.

There are two types of individual retirement arrangements (IRAs): Traditional and Roth. Though the eligibility requirements differ, often the decision of whether to contribute to a Traditional IRA or a Roth IRA depends on your income. Both offer flexibility, accessibility, and valuable tax benefits.

Roth IRA

- You may qualify for a tax credit of up to $1,000 when you make a contribution.

- You can withdraw Roth IRA contributions at any time, tax and penalty free.

- Any earnings are tax-deferred (you do not pay tax on the earnings until you withdraw them.)

- If you satisfy the qualified distribution requirements, you can withdraw the earnings tax free.

- You are never required to take money out of your Roth IRA, no matter what your age.

Traditional IRA

- You may qualify for a tax credit of up to $1,000 when you make a contribution.

- Any earnings are tax-deferred (you do not pay tax on the earnings until you withdraw them.)

- If your contributions are tax-deductible, you do not pay taxes on them until you withdraw the money.

- Any after-tax amounts (nondeductible contributions) can be withdrawn tax and penalty free.

Before you start saving with a Traditional or Roth IRA, you may have some basic questions. The answers will help you distinguish the differences between each.

| Question | Roth IRA | Traditional IRA |

|---|---|---|

| Can I contribute? |

You are eligible to contribute to a Roth IRA if you earn compensation or file a joint tax return with a spouse who earns compensation, and your modified adjusted gross income (MAGI) is less than or within the defined limits.

See the MAGI chart below.

|

You are eligible to contribute to a Traditional IRA if you earn compensation or file a joint tax return with a spouse who earns compensation. Starting with the 2020 tax year, you may make a contribution at any age. |

| How much can I contribute? | Depending on your MAGI, you may be able to contribute up to $7,000 for 2025 ($7,500 for 2026) or $8,000 for 2025 ($8,600 for 2026) if you are age 50 and older. Regular contributions to both Traditional and Roth IRAs in aggregate cannot exceed these limits, and contributions cannot exceed your annual compensation. |

You can contribute up to $7,000 for 2025 ($7,500 for 2026) or $8,000 for 2025 ($8,600 for 2026) if you are age 50 and older. Contributions cannot exceed your annual compensation.

|

| Can I take an income tax deduction for my contribution? | Roth IRA contributions are not tax-deductible. | Whether your Traditional IRA contribution is deductible on your federal income tax return depends on your marital and tax-filing status, and whether you or your spouse actively participate in an employer-sponsored retirement plan. If neither of you is an active participant, you are eligible to deduct your full contribution. Otherwise, you'll need to refer to the MAGI limits for deductibility to determine how much you can deduct. |

What is MAGI?

MAGI is your adjusted gross income before a Traditional IRA deduction (and certain other limited deductions or adjustments to income) are made. MAGI limits are subject to annual cost-of-living adjustments (COLAs).

What are the MAGI limits?

Roth IRA

The MAGI limits for a Roth IRA are used to determine if and how much you can contribute.

| Tax-Filing Status | Full Contribution Allowed | Partial Contribution Allowed | No Contribution Allowed |

|---|---|---|---|

| Single (2025) | $150,000 or less | $150,000 - $165,000 | $165,000 or more |

| Single (2026) | $153,000 or less | $153,000 - $168,000 | $168,000 or more |

|

Married, Filing Jointly (2025)

|

$236,000 or less | $236,000 - $246,000 | $246,000 or more |

| Married, Filing Jointly (2026) | $242,000 or less | $242,000 - $252,000 | $252,000 or more |

Traditional IRA

The MAGI limits for a Traditional IRA are used to determine if and how much you can deduct.

| Tax-Filing Status | Active Participant | Full Deduction Allowed | Partial Deduction Allowed | No Deduction Allowed |

|---|---|---|---|---|

| Single (2025) | Yes | $79,000 or less | $79,000 - $89,000 | $89,000 or more |

| Single (2026) | Yes | $81,000 or less | $81,000 - $91,000 | $91,000 or more |

| Married, Filing Jointly (2025) | Yes | $126,000 or less | $126,000 - $146,000 | $146,000 or more |

| Married, Filing Jointly (2026) | Yes | $129,000 or less | $129,000 - $149,000 | $149,000 or more |

|

Married, Filing Jointly (2025)

|

No, but

spouse is

|

$236,000 or less | $236,000 - $246,000 | $246,000 or more |

| Married, Filing Jointly (2026) |

No, but

spouse is

|

$242,000 or less | $242,000 - $252,000 | $252,000 or more |

When can I withdraw the money?

You may withdraw money from either type of IRA at anytime, subject to federal income tax. If you are under age fifty-nine and a half, you will also be subject to a 10 percent early distribution penalty tax on any taxable amount taken, unless you qualify for a penalty exception: death (beneficiary distributions), disability, certain health insurance costs, certain medical expenses, higher education expenses, first-time homebuyer expenses, birth of a child or adoption expenses, substantially equal periodic payments, IRS tax levy, qualified military reservist distributions, qualified disaster-related distributions, or distributions due to a terminal illness, domestic abuse, or emergency expenses.

Will I ever be required to withdraw the money?

- Roth IRA - No. Roth IRA owners are never required to take distributions. After your death, however, your beneficiaries will be subject to required distributions (unless a spouse beneficiary treats the IRA as their own).

- Traditional IRA - Yes. Traditional IRA owners are required to take annual minimum distributions beginning with the year they turn age 73 (or age 72 for those born July 1, 1949 to December 31, 1950, or age seventy and a half for those born on or before June 30, 1949). Your beneficiaries also will be subject to required distributions.

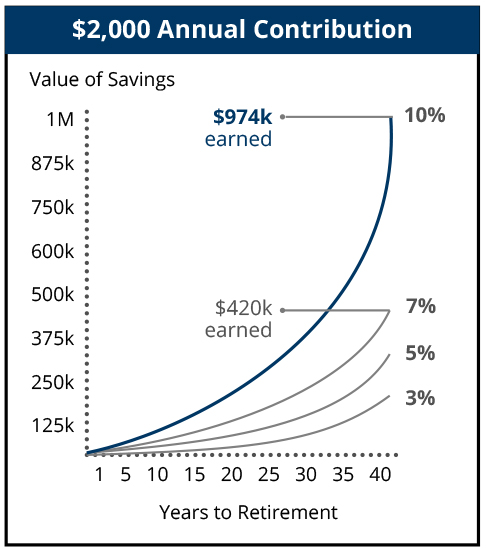

Save more when you start sooner.

Whether you're just beginning your career, planning for your family, or approaching retirement, it's never too late to start saving with an IRA. But the sooner you start, the greater the effect of compound interest on your savings.

Click the image below for a printable version of the above information:

Please contact TrueCore by calling 740-345-6608 or emailing info@truecore.org for more information on IRAs.

26240-EB (11/2025) ©2025 Ascensus, LLC