Understanding Your Credit Score

Healthy credit is a key component of qualifying for mortgages, auto loans, and even new jobs. A FICO

score is the three-digit number that summarizes your credit report. It’s only a small slice of the credit

pie, but it’s a very important one. Understanding what it all means will greatly improve your chances for

obtaining the highest credit score possible.

FICO® Score Frequently Asked Questions

What are FICO® Scores?

FICO® Scores are numbers that summarize your credit risk. Scores are based on a snapshot of your credit file at particular consumer reporting agencies at a particular point in time, and help lenders evaluate your credit risk. FICO® Scores influence the credit that's available to you and the terms, such as interest rate, that lenders offer you.

Why does TrueCore provide my FICO® Score?

Knowing your FICO® Score is important for understanding the overall state of your credit. One of the missions that your fellow members, the TrueCore Board of Directors, has given to us is to provide financial education and information to the TrueCore membership. Our FICO® Score program is a key part of that member education.

Whatever your score is, we encourage you to look through the material here. If your score is lower than you'd like, there is some great information on meaningful steps you can take to learn more about credit and healthy finances. If you already have a high score, the information here will help you protect and better understand what impacts your score.

What does my FICO® Score mean to me?

Different consumers of your credit information, such as lenders, landlords, etc. may all have their own credit risk standards, but generally:

- Anything at 800 or above is considered exceptional.

- 740 - 799 is very good

- 670 - 739 is good

- 581 - 669 is fair

- Anything less than 581 is considered poor

Why does my FICO® Score matter?

Your score impacts your ability to attain credit, and how much that credit will cost you. The better your score, the more likely you will be able to get a loan when you need one, and the lower the rate may be.

It may also impact your ability to rent an apartment.

How are FICO® Scores calculated?

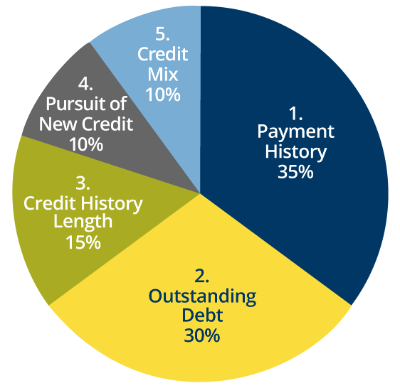

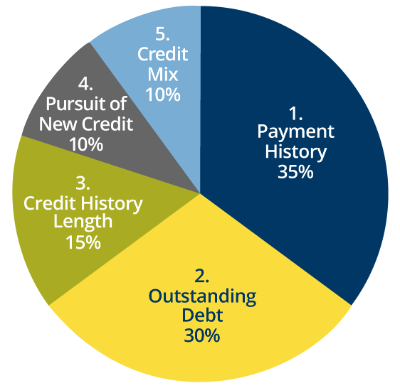

FICO® Scores are calculated from many different pieces of credit data in your credit report. This data is grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining how FICO® Scores are calculated.

- History: 35%; including missed or late payments, collections and public records.

- Amount Owed: 30%; credit utilization, one of the most important factors evaluated in this category, considers the amount you owe compared to how much credit you have available.

- Length of Credit History: 15%; in general, a longer credit history will increase a FICO® Score, all else being equal. However, even people who have not been using credit long can get a good FICO® Score, depending on what their credit report says about their payment history and amounts owed.

- New Credit: 10%; opening several credit accounts in a short period of time represents greater risk—especially for people who do not have a long credit history.

- Types of Credit in Use: 10%; FICO® Scores consider your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. It is not necessary to have one of each, and it is not a good idea to open a credit account you don’t intend to use.

How often will I receive my FICO® Score?

Program participants will receive their updated FICO® Score 2 based on Experian data on a quarterly basis, when available.

Please note that only the primary member on an account may see the FICO® Score. If you are a joint member on an account, you may start to receive your FICO® Score by opening a separate account with yourself as the primary account holder. Please contact

info@truecore.org or call 740-345-6608 for details on opening your own account.

Will receiving my FICO® Score impact my credit?

No. The FICO® Score we provide to you will not impact your credit.

Why is my FICO® Score not available?

Only the primary member on an account may view their FICO® Score. If you are a joint member on an account, you may start to receive your FICO® Score by opening a separate account with yourself as the primary account holder. Please contact info@truecore.org or call 740-345-6608 for details on opening your own account.

It is also possible that we did not receive a score for your account. Many factors can lead to your account not being able to be scored by Experian, such as lack of credit history, inability of Experian to identify you, etc. For specific details, please contact info@truecore.org or call 740-345-6608.

Where does the information used to calculate my FICO® Score come from?

A FICO® Score is based on the credit information in a credit file with a particular consumer reporting agency (CRA) at the time the score is calculated. The information in your credit files is supplied by lenders, collection agencies and court records. Not all lenders report to all three major CRAs. The FICO® Score 2 that we provide to you is based on data from your Experian credit report as of the ‘pulled on date’ shown with your score.

What are Key Score Factors?

When a lender receives a FICO® Score, "key score factors" are also delivered, which explain the top factors from the information in the credit report that affected the score. The order in which FICO® Score factors are listed is important. The first indicates the area that most affected that particular FICO® Score and the second is the next significant area. Addressing some or all of these key score factors can help you better understand your financial health over time. However, if you already have a high FICO® Score (usually in the mid-700s or higher) score factors may not be as helpful, since they represent very marginal areas where you could improve your financial health.

Why is my FICO® Score different than other scores I’ve seen?

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a particular consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores. The FICO® Score 2 based on Experian Data that is being made available to you through this program is the specific score that we use to manage your account. When reviewing a score, take note of the score date, consumer reporting agency credit file source, score type, and range for that particular score.

How do I know if the information used by the bureaus is correct?

AnnualCreditReport.com is the only official and truly free way to get your credit report. What you can get from AnnualCreditReport.com is your detailed credit report, which does not include your score. Using the credit reports, you can understand in detail what is going into your score, as well as inspect your credit history for incorrect information. Please note: if you find incorrect credit information on your credit history, you will need to contact that bureau to have it corrected.

Dispute information for the three major bureaus:

- Experian

- TransUnion

- Equifax

Other Resources

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. TrueCore Federal Credit Union and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. TrueCore Federal Credit Union and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.